It was nearly two o’clock in the morning before members of British Columbia’s Legislative Assembly finished debating and voting on Bill 8, the Carbon Tax Amendment Act.

The piece of legislation was pushed through at the last minute to align provincial carbon pricing with the federal levels carbon tax rate announced in early March. The goal was to have it in place before the scheduled April 1 price increase.

All but the two Green Party MLAs eventually voted in favour of setting the carbon price to zero, after debating the bill’s merits and pointing out problems that were created by the NDP government’s flip-flop on the carbon tax.

Finance critic and MLA for Kelowna Centre, Peter Milobar, spent hours on Monday night asking Finance Minister Brenda Bailey for answers.

According to Milobar, the government didn’t need to wait until the last minute to bring this bill forward. It could have recalled the legislature at any time during its spring break. In fact, Milobar said the government could have prepared the bill and distributed it to all MLAs at any point since January, when it was clear that the top contenders for leader of the federal Liberal Party planned to remove the consumer carbon tax.

Bailey maintained that this was the first opportunity the government had.

Milobar hammered her repeatedly the $1.8 billion in lost provincial revenue because of Bill 8, as well as the cuts the government would have to make to account for this shortfall. The Homeowner Grant for rural and northern residents, was one of these programs that could face the chopping block.

“In 2009 when the carbon tax was first introduced, the Homeowner Grant for rural and northern residents was increased by $200 a household,” he said. “I think the homeowners in rural and northern BC would like to know whether their $200 homeowner grant is in jeopardy with Bill 8 or not.”

Bailey however, simply replied that the government was undertaking a review of all programming, and the information would be put out in Q1.

Milobar noted that property tax notices will be going out soon, with property taxes due at the beginning of July, and the Q1 report won’t be out until at least August.

“The bottom line is that this process will have come and gone, as the Minister is talking about what may or may not be included with the $1.8 billion of cuts this government needs to make,” he said.

“So again, when will homeowners find out whether or not the extra $200 on their Homeowner Grant, which is directly attached to the carbon tax and has been since 2009, will still be in effect or be cut?”

In its press release about cancelling the carbon tax, the government said that it would have an estimated impact of $1.99 billion on the coming fiscal year, and that programs funded by carbon tax would have to be restructured to minimize the impact on the budget.

The climate action tax credit is the first to be cancelled, with the last payment going out this month.

“We remain committed to driving down emissions while making life more affordable,” Adrian Dix, Minister of Energy and Climate Solutions said.

“We are continuing to invest in practical solutions, such as home heat pump rebates for those who need them most and energy-efficiency upgrades, so people can lower their energy costs and reduce emissions without bearing an extra financial burden.”

The province says it will “continue to ensure big polluters pay through the BC output-based carbon pricing system.”

Organizations like the Canadian Taxpayers Federation say that keeping a carbon price on industry and the “big polluters” will lead to further increases in prices as companies aren’t going to eat those costs, they have to recoup those taxes somehow.

In his speech in the legislature just before the vote, Peace River North MLA Jordan Kealy pointed out that large companies have already improved their standards of emissions, such as tractor manufacturers, which he says have enabled producers like him, to reduce emissions on their farms. He believes farmers themselves have had a bigger impact on reducing emissions than the carbon tax has.

“When they’re buying tractors that have a better tiered engine, that meet emissions controls. I’m not doing that because I get a bonus on the carbon tax. I’m doing that because companies are already improving their standards of emissions,” Kealy said.

Kealy also called out statements like Dix’s about heat pumps, saying that pushing EV’s and heat pumps is a manifestation of the rural-urban divide, punishing those who live in the North for living in the North.

Heat pumps and EV’s aren’t designed for the harsh Northern climate. A heat pump, Kealy noted doesn’t cut it at -40°C. In a city like Vancouver or Victoria, there’s plenty of places to plug in that EV to charge it up. Not so in the North.

“We don’t have a choice,” Kealy said. “I have a farm; I’m not going to just pack-up and leave and live in the Lower Mainland and have a Smart Car.”

The only thing a carbon tax is good for Kealy says is “to try to replenish the coffers of a government that can’t seem to handle their money.”

“I would like to see government focus on good governance and supporting the private sector, and getting our resource sector going strong again,” he said. “I believe that’s where we have the potential for paying off debts.”

Kealy warned that BC’s carbon tax isn’t really going away.

“This Act isn’t getting dissolved. There’s still the potential for this carbon tax to easily come back. This is done out of political strain and pressures.”

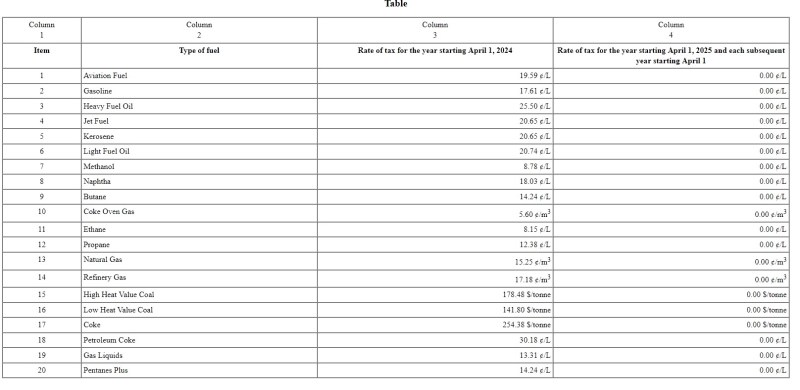

It’s right there in the regulations, in Section 9 of the Carbon Tax Amendment Act 2025:

(4) This section and any regulations made under this section are repealed on April 1, 2026, or on an earlier date prescribed by the Lieutenant Governor in Council.

Zero carbon tax is a welcome, but temporary reprieve.

Have an insight or additional info regarding this article? Feel free to drop a comment!